Understanding the True Cost of an Employee

An employee costs a company more than just their individual hourly wage or yearly salary. All business owners should be conscious of the true cost of an employee by full understanding where all additional costs exist, and how to account for them.

The of true cost of a worker is typically 20-25% more than their base salary. This number only increases with the time and expenses associated with the interview and training processes. In order to properly calculate the true cost of an employee you have to account for the following 5 categories of expense:

- Payroll Costs

- Fringe Benefits

- Administrative Costs

- System/Tools

- Workspace

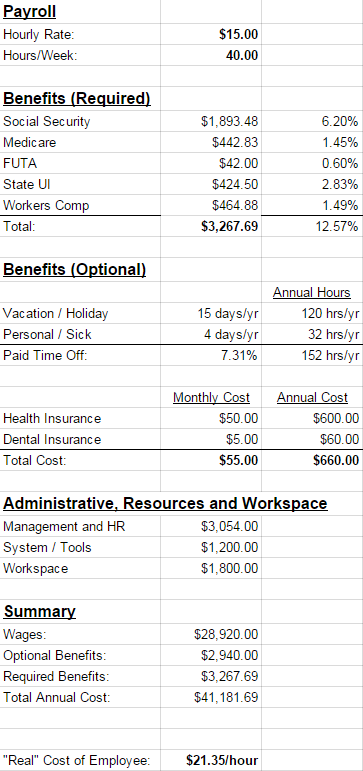

The following spreadsheet functions as an example for how to properly calculate the true cost of an employee using these five categories. In our example we are considering hiring a customer support team member at $15/hr with a gross salary of $31,200 a year.

Having this knowledge and ability to compute employment costs, will lead to more profitable decision making. If you have a strong detailed sense of what you are paying every employee, you will more effectively delegate work, have a better sense of overtime costs, and meet profit goals.

Not only should hourly wages be tracked, but work and progress as they pertain to a product or service your company offers. Knowing how long it takes an employee to accomplish specific tasks allows you to not only better delegate work based off of productivity, but more effectively price your products as well. How can you properly assign a price to a product or service without knowing the costs it takes to create and deliver them? With knowledge of labor costs and manufacturing costs, a company will much more effectively set your gross margins.

Ultimately as you grow your company and bring on new talent, it is crucial to understand true costs. This understanding will undoubtedly lead to more informed and financially efficient decisions.